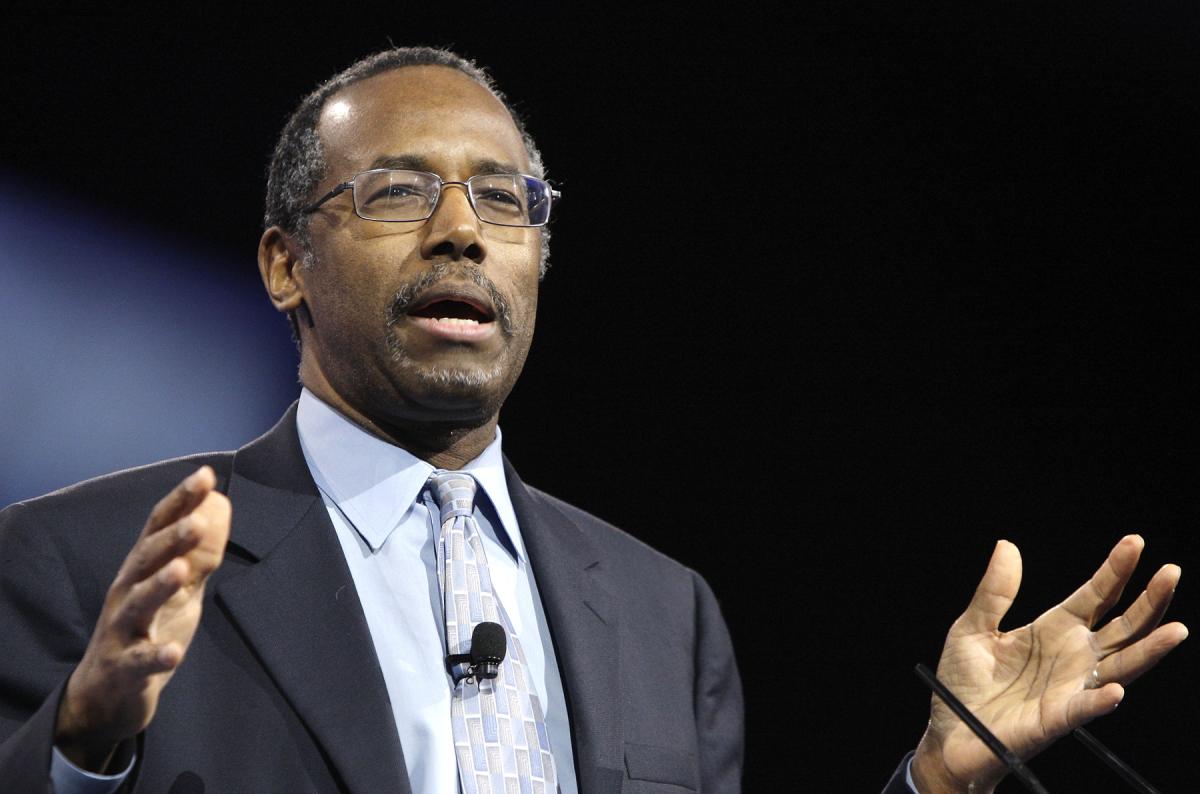

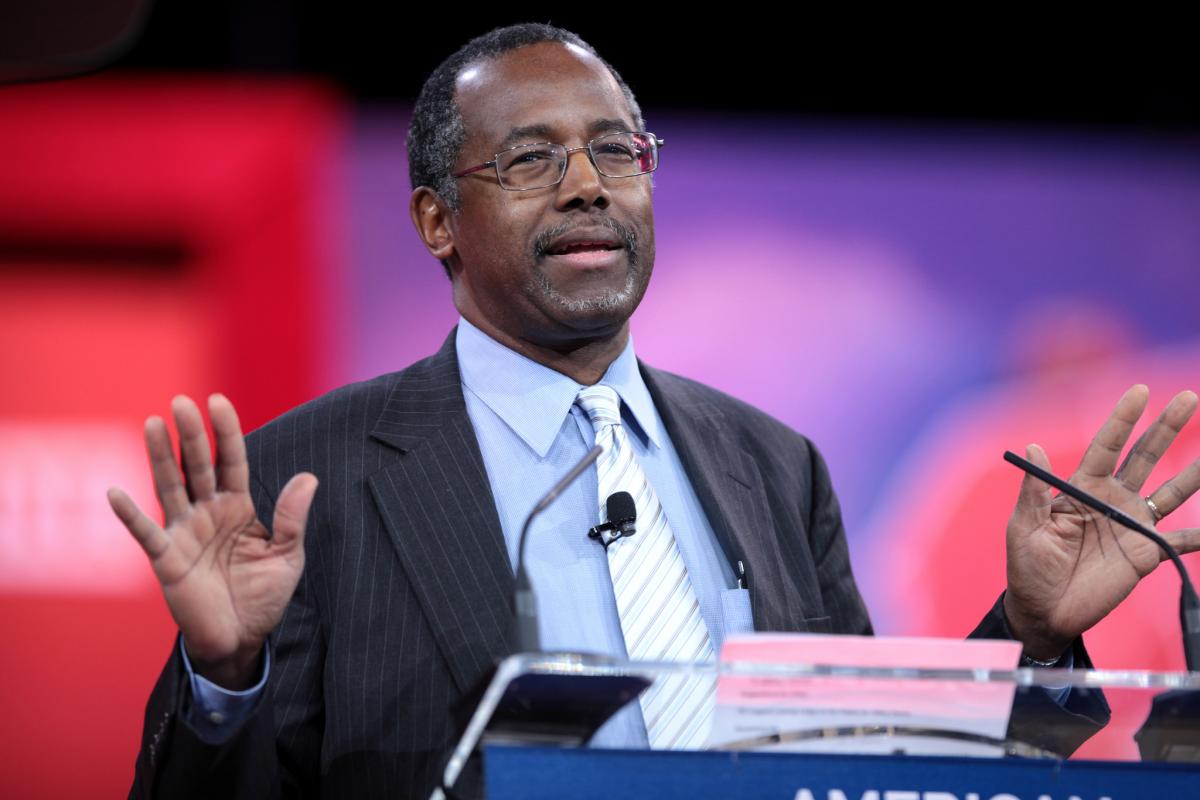

In last night’s Republican presidential debate, retired neurosurgeon Ben Carson said he would base a new tax system on the biblical system of tithing. “I think God is a pretty fair guy,” he said.

And he said, you know, if you give me a tithe, it doesn’t matter how much you make. If you’ve had a bumper crop, you don’t owe me triple tithes. And if you’ve had no crops at all, you don’t owe me no tithes. So there must be something inherently fair about that.

And that’s why I’ve advocated a proportional tax system. You make $10 billion, you pay a billion. You make $10, you pay one. And everybody gets treated the same way. And you get rid of the deductions, you get rid of all the loopholes, and…

Carson has plenty of company on the far right. The American Family Association’s Bryan Fischer has declared, “God believes in a flat tax.” On his radio show last year, Fischer said, “That’s what a tithe is, it’s a tax.”

Of course, that kind of flat tax would amount to a massive tax cut for the richest Americans and a tax hike on the poorest. So it’s not terribly surprising the Koch brothers’ Americans for Prosperity has teamed up with the Religious Right to promote the idea that progressive taxation is an un-Christian idea. AFP joined Religious Right groups to create the Freedom Federation, one of the right-wing coalitions that sprung up in opposition to Barack Obama’s election as president. The coalition’s founding “Declaration of American Values” declares its allegiance to a system of taxes that is “not progressive in nature.”

David Barton, the pseudo-historian, GOP activist, and Glenn Beck ally, is a major promoter of the idea that the Bible opposes progressive taxes, capital gains taxes, and minimum wage. Barton’s views are grounded in the philosophy of Christian Reconstructionism, a movement whose thinking has infused both the Religious Right and Tea Party movements with its notion that God gave the family, not the government, responsibility for education — and the church, not the government, responsibility for taking care of the poor.

That’s how we have Republican members of Congress supporting cuts in food stamps by appealing to the Bible. And how we get Samuel Rodriguez, the most prominent conservative Hispanic evangelical leader, saying that a desire to “punish success” — i.e. progressive taxes — “is anti-Christian and anti-American.”

This notion that laissez-faire economics, small government, and flat taxes are divine mandates, and that taxation is theft, is also how we end up with the Heritage Foundation promoting the idea that “[t]hose who esteem the Bible should also applaud St. Milton Friedman and other Church of Chicago prelates, because their insights amplify what the Bible suggests about economics.” And the idea that unions and collective bargaining are unbiblical is how we get Religious Right groups celebrating Scott Walker’s war on unions.